- Accessibility that anyone can easily access

- Provides ease of use through stable transactions

- NFT A trading platform that can also be linked with NFT assets

We would like to open a new platform so that customers, not large institutions, can directly manage their assets. And through this, we build a stable asset trading and management service in the virtual asset market. That is HYPE's vision for a new customer service. Blockchain is an important tool shaping the future of virtual asset trading. In particular, transaction services using virtual assets are the biggest topic in the new virtual asset market. Until the day that all digital assets are traded safely and freely in the decentralized financial market, we will continue to upgrade and create services for our customers.

Our purpose is to bring reliable service through stable transactions to our customers. For that, HYPE has several purposes.

- Services are available with minimal control.

- We want to build a new UIUX for customer convenience.

- Entry/exit by customers should be immediately available without restrictions.

- Staking service is supported to maximize customer return, and transactions can be made during staking service.

- Exchanges between virtual assets are quick and easy.

- All policy decisions are made by Vote within the DEX.

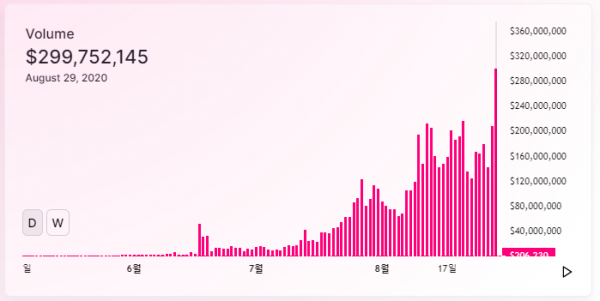

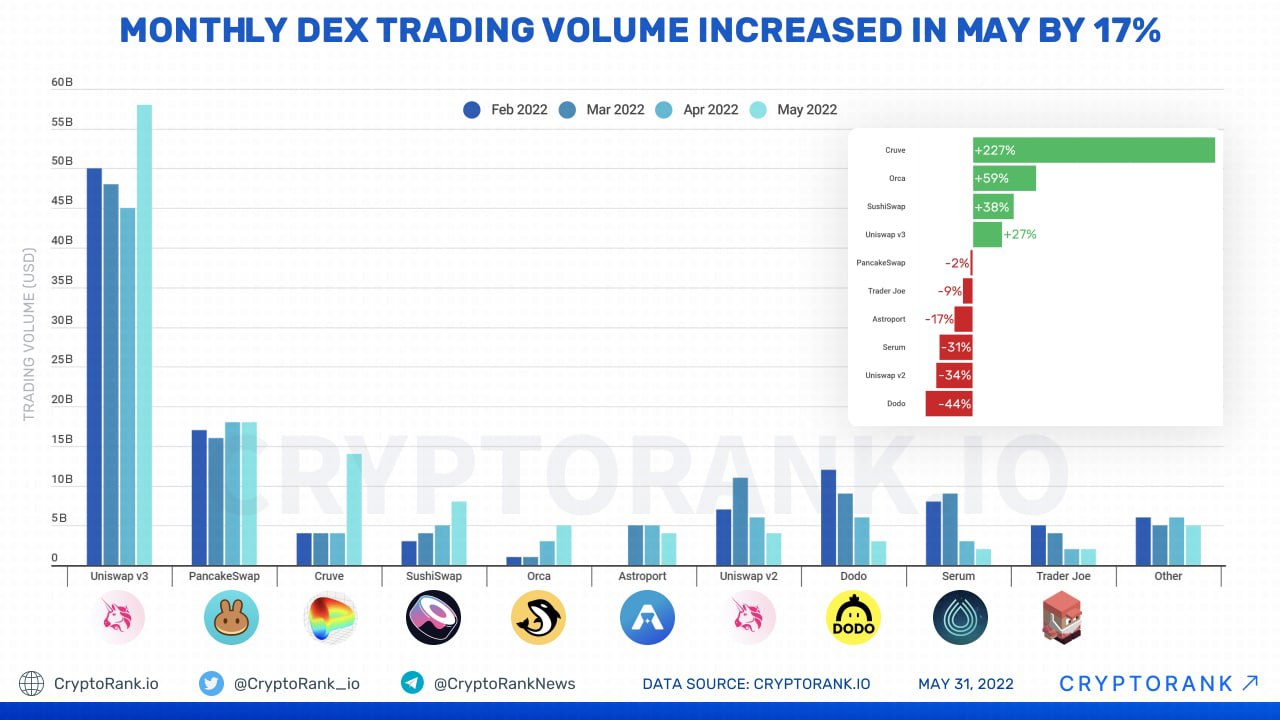

Status (DEX)

The weekly trading volume of the decentralized exchange (DEX) UNISWAP has exceeded $10 billion. It is worth more than 11 trillion won in Korean Won. According to a tweet posted by UNISWAP Chief Executive Officer Hayden Adams on the 20th (local time), UNISWAP's weekly

trading volume continues to remain at a similar level, it has the potential to reach $500 billion in annual trading volume. Cryptocurrency data provider Coingecko estimates 24-hour trading volume at $1.9 billion.

UNISWAP is a decentralized exchange protocol built on the Ethereum network. By introducing the concept of a “liquidity pool” in which users create a pool of cryptocurrency pairs they want and obtain a transaction fee, it compensated for the chronic liquidity supply problem of decentralized exchanges. In particular, it gained popularity by Airdorp 400 units of its own governance token UNISWAP (UNI) in a wallet that has used the UNISWAP exchange at least once in September last year.

Due to the DeFi craze that started in the middle of last year, UNISWAP transaction volume is rapidly increasing. In February, the cumulative trading volume exceeded 100 billion dollars. UNI prices are also skyrocketing. As of 10:44 am on the 21st, the price of UNI is 32.15 dollars as of Coinmarketcap. It is up 701% compared to 7 months ago. Pancakeswap and MDEX, which are considered to be representative decentralized exchanges along with UNISWAP, also showed that their 24-hour trading volume exceeded 3 billion dollars.

Token Supply

Token

TokenSupply

- Initial Fair Distribution 45%

- Team/Founders 10%

- Advisors/Angel Investors 5%

- Partnership Reserve 5%

- Marketing Reserve 5%

- Centralized Exchange Liquidity 15%

- New Feature Reserve 15%

Roadmap

2020

| 08 |

Established DEX Lab. DEX Engine development started |

| 12 |

Smart contract development and audit application HYPE Web service open Hype is successfully listed on Coinbene Exchange for public trading |

2021

| 03 |

Business has been officially launched in January 2021 HYPE's Asia AMA for Asia KOL. Uniswap listing is released (HYPE Listing & HYPE LP Pool ) "New DEX Service Launch of more swapping assets HYPE's first Reward boosting opened." |

| 07 |

Started the first distribution service of Governance Token. HYPE's second reward boosting open. |

| 10 |

Supreme NFT exclusive contract Opened NFT Marketplace Start of development of connection between NFT Token and DEX service |

2022

| 03 |

Opened Multi NFT-DEX Market place Mobile Application open Start the Final Booster service |

| 10 |

Contents NFT Market Open Media NFT Metaverse Open |

2023

| 01 |

DEX 1.0 Exchange Open DEX 1.0 Technical partnership with NASDAQ |

| 04 |

DEX Mobile Service scheduled to open DEX Wallet Service scheduled to open |

| 09 |

HYPE DEX 2.0 scheduled to open DEX 2.0 support for WEB 3.0 |

2024

| 03 |

Arbitrage Service Open (Babel Club) Asia Campaign in Dubai |

| 07 |

Arbitrage Service 2.0 Open (Babel Club) USA Campaign |

| 10 |

Global Campaign in Singapore Arbitrage with multi-chain support |

2025

| 01 |

Establishment of an integrated trading system |

| 07 |

Launch of integrated arbitrage service |

Team & Advisor

Hassan Ibrahim

CEO

In order to open DeFi financial services with the best marketability, various talents were recruited and the foundation of financial services for virtual assets was created. As a financial expert, I am developing my business through various connections across the UK, Dubai, and Asia. Our Supreme Finance service is a customer-oriented service that is easy and simple, but boasts the most efficient and high compensation service. In particular, collaboration in financial services with NFTs will be our most powerful weapon. We will do our best until it becomes a service that is continuously stabilized and represents a part of the market. Thank you all customers.

Supreme Finance CEO (2020~)

AVIVA Programme Manager

JH Fin Tech Consultants Ltd Director

CoinBene Europe COO

Jon Whitehead

CMO

Pedersen & Partners Manager

SES Managing Director

Robert Walters Country manager

Harvard Business school (Leading & Finance)

Pham minh triet

ADVISOR (Vietnam)

Solcoms Vietnam CEO

Fe Credit - Unit Head Of Customer Service

True Money - Digital Marketing Manager

Srian Leanage

CSO

IT Solution expert & 20 years at IT Director

Supreme Finance CSO

CoinBene UK CSO

HP Sales certified (Business License)

Eurolaser International Director

Kevin McLaughlin

CCO (Contents / System Architecture)

Supreme Finance CCO

First Point Group Commercial Director

Atomic Idea Singapore CCO

Networkers International Head of Commercial

Spring Technology Senior customer manager

Phan thanh quyen

Legal advisor

Gold Law Company Managing Director

Attorney At Law

Ho Chi Minh University Of Law

Yan jiang

Asia Marketing Chief

CoinSuper Director & Business Development

CoinTiger Marketing Director

Coinbene Global BD Director

BCEX BD Director

Xi’an International Studies University

Ismail Malik

Marketing Advisor

Experts who can provide leadership and strategic direction to support service-oriented and cost-effective activities related to sourcing, contracting, eMoney, tokenized credit services, and DeFi decentralized finance. He is designing a disruptive, decentralized approach to innovation for rapid growth, building connections with local players, enabling stronger, deeper distribution networks that enable fast tracking onboarding/user activation.

Anastasia Lachmann

West USA Marketing

Real Estate Investor and Entrepreneur/Crypto Enthusiast 2018-Current

Manager of Administrative Office/ Private Insurance Representative/ Company Trainer, HDI Insurance Karlsruhe. 2012- Current

Humanitarian Global Volunteer for ADRA 2011-2012

Educational Department Assistant/ Elementary Sector Selbach, Gaggenau

Anh Le

Asia Marketing Advisor

Bought her first Bitcoin since 2016, with knowledge gained from years living in UK , Anh has been actively involved in crypto space, organizing 11 events across Southeast Asia, covered the most number of mainstream PR & KOLs in Vietnam. Her mission is to bridge internationals with local communities.

Antoh Tony

Middle Asia Marketing

Founder of Angel Investing, Startup & Executive Advisory

Manager of Top Tier Impact

Labs Publicity Group. Technical reviews, Guerrilla marketing

University of Pennsylvania - The Wharton School

Matthew Morea

East USA Marketing

HYPE Marketting, New York, United States

Carmaven CEO

Senier Sales Rep. Central Ave Chrysler

Ito Showichi

Local Advisor(Japan)

Global tour in Japan

MASATO Corporation

NIHOGN University Law Course

Nishikawa

Local Advisor(Japan)

GOYO Corporation

CHIBA University Business Administration